Florida: A Hot Spot for Opportunity Zone Investment

Recent IRS guidance regarding Opportunity Zones may unleash hundreds of billions, if not trillions, of unrealized gains into qualified, new real estate investment and Opportunity Zone Businesses, but the clock is ticking to maximize the program’s advantages, according to Opportunity Zones: Location, Timing, Capital, a new report released by Cushman & Wakefield.

So how does an Opportunity Zone investment work? The program allows for tax on any capital gains to be deferred, provided those gains are invested in a “Qualified Opportunity Fund” (QOF) within 180 days. If the Opportunity Zone investment is held for five or seven years, the basis for the original capital gain is adjusted upward, thus deferring or reducing tax liability by up to 15%. A QOF investment that is held for 10 years results in no capital gains tax.

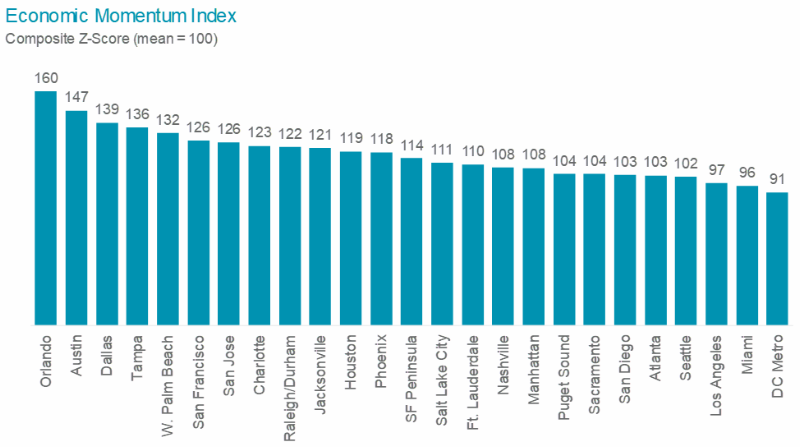

Cushman & Wakefield evaluated 45 office and multifamily markets containing 2,700 of the approximately 8,700 Opportunity Zones across a range of factors indicative of economic momentum. These factors were divided into three categories: tax and regulatory, including State Tax Confirmation Status (Wharton Land-Use Regulation Index); economic drivers (five-year forecasts for population growth, employment growth and household income); and CRE fundamentals (2019 office and multifamily inventory, vacancy and growth).

Several Florida markets top the list, as growing populations support economic and commercial real estate fundamentals, and the tax regulatory environments are generally favorable for development. See how Florida markets stack up, below: